A new starting point for the “BTA-Fransabank Retail Index”

What happened after October 17, 2019 is not comparable to what was before

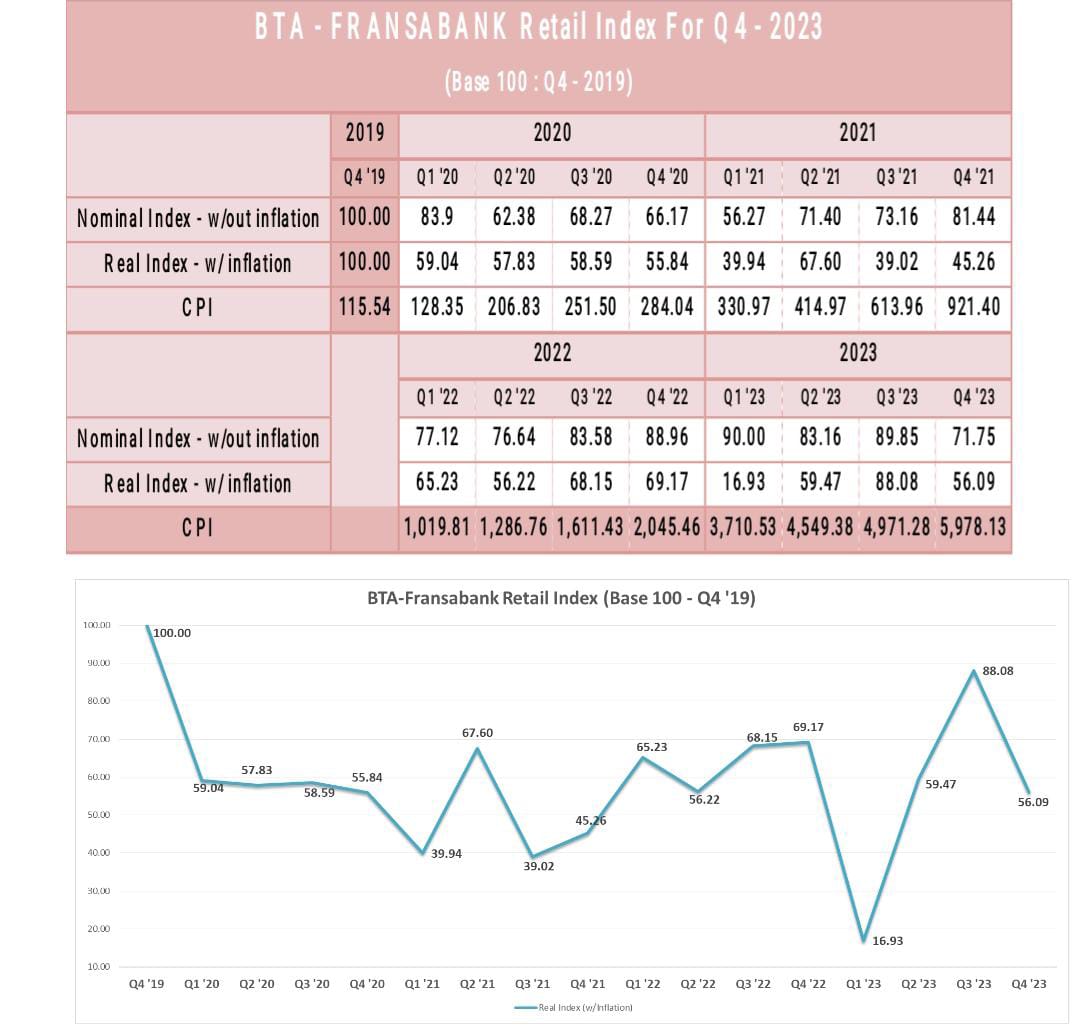

Starting this quarter (Q4 – 2023), the calculation of the variations occurring in the real turnover of Retail Trade Businesses has been reset and will start at the fourth quarter of 2019, this quarter representing a new era in the Lebanese economy, and hence a new starting point for the BTA-Fransabank Retail Trade Index (The Index from this quarter onwards will thus start with Base = 100 on Q4 – 2019). The variations in real turnover figures (i.e. properly weighed according to official CPI figures published by CAS), are calculated on a quarterly basis. With this new base, observers shall be able to assess the changes in the local trade business climate, a climate that has been going since through a noticeable transformation.

From this period onwards, an accelerating downward trend was observed in the markets, albeit with brief and short-lived periods of regain in activity and the overall consumption trend has been witnessing a generalized slowdown.

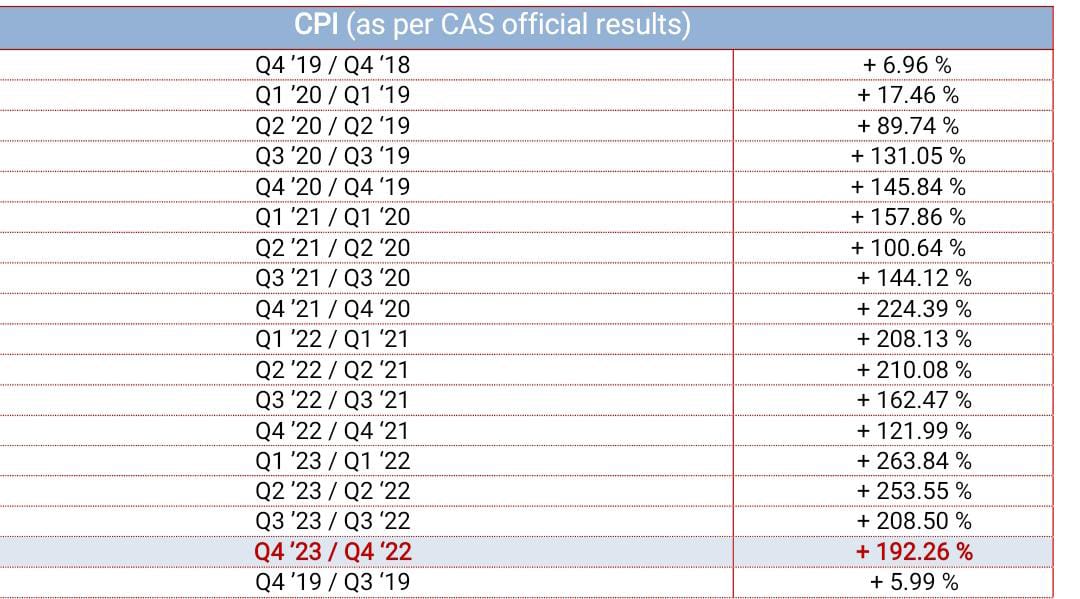

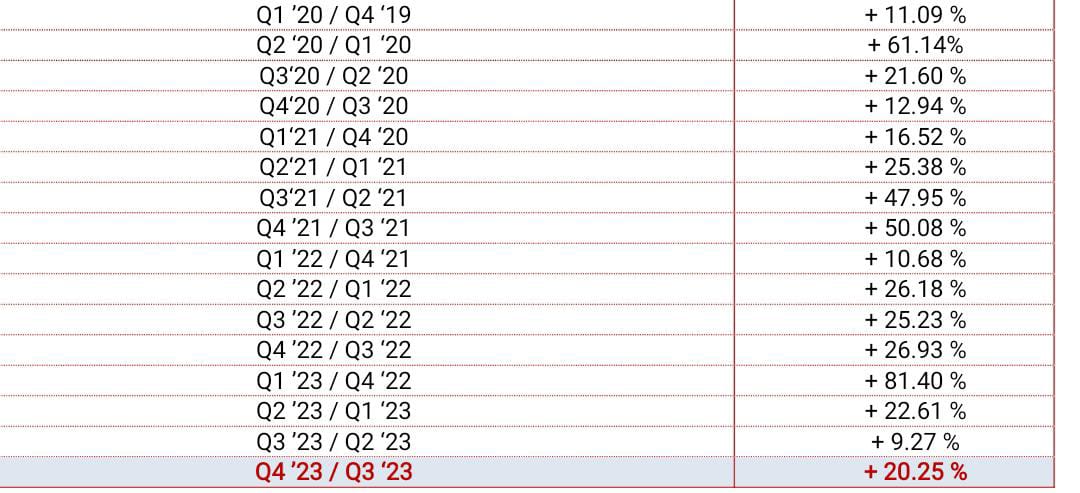

The accelerating deterioration on the regional scene during the last quarter of 2023, with all its direct and immediate impact on the Lebanese economic and social scene, contributed into a further worsening of the consumption momentum in the markets and invigorating the recessionary trend. Such factors were accompanied by an increase of + 192.26 % in the CPI between the 4th quarter of 2022 and the 4th quarter of 2023 (still standing among the highest in the world), while the quarterly CPI increase stood at + 20.25 %.

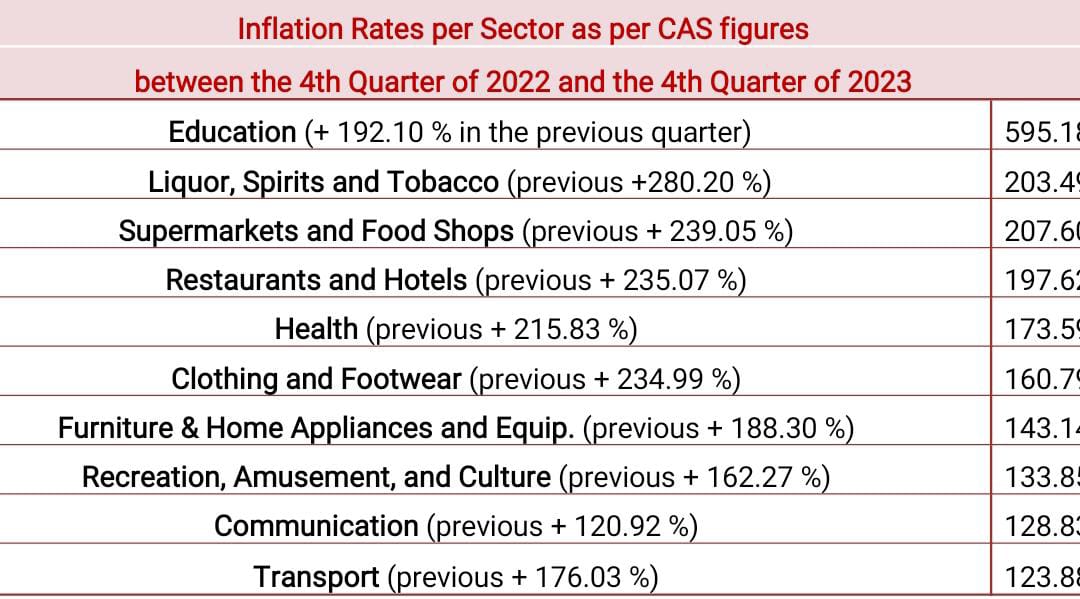

The CPI increases relative to every sector were, between the 4th quarter of 2022 and the 4th quarter of 2023, as follows:

As a result of all the above factors, the consolidated “nominal” retail trade turnover figures for the fourth quarter of 2023 showed only a + 8.08 % increase in comparison with the figures of the fourth quarter of 2022 if we exclude the Fuel sector, where a + 10.02 % increase was posted in terms of quantities sold.

This + 8.08 % increase in the nominal turnover figures represents of course the consolidated increase in nominal turnovers in every sector before weighing with the sector’s corresponding CPI rate (as per the official classification of the Ministry of Finance).

But, after applying the proper weighting with the CPI for the period under review (+ 192.26 % between Q4 of 2022 and Q4 of 2023), it appears that “real” turnovers continued to drop in all retail trade sectors, noticeably in the supermarkets and food products sector, Bakeries and Pastries, Clothing, and also in the Construction Materials sector, while, as indicated beforehand, the Fuel sector posted a + 10.02 % increase in terms of quantities sold.

Simultaneously, the quarterly CPI increase between Q3 ’23 and Q4 ’23 seemed to regain momentum, with a hefty price increase of + 20.25 % figure as compared to + 9.27 % in the previous quarter.

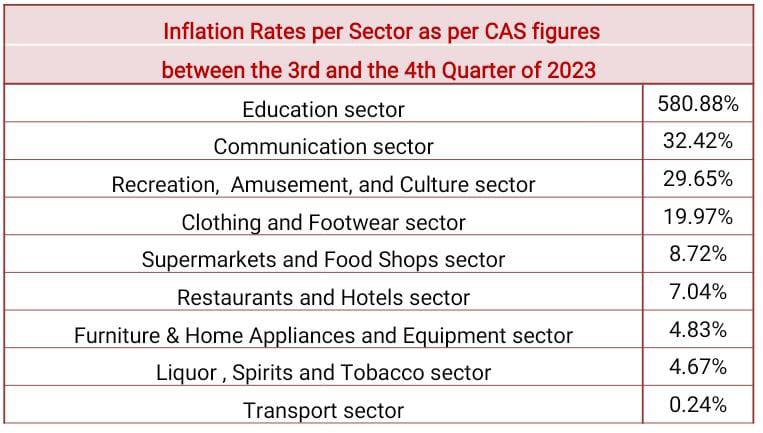

The quarterly CPI increases relative to every sector were, between the 3rd and the 4th quarter of 2023, as follows:

Such CPI increased rates did affect the consolidated results of the markets, and variations between the third and the fourth quarters of 2023 did show a heavy “real” deterioration of – 40.29 % (i.e. after weighting with the corresponding CPI and excluding the Fuel sector – as compared to the + 8.59 % increase experienced during the preceding summer season). The results of the Fuel sector did also experience a – 12.75 % drop in terms of quantities sold (as expected after the departure of summer season visitors).

These negative results were quite noticeable in some sectors as can be seen below:

- Construction Materials (- 86.17 %)

- Restaurants and snacks (- 42.95 %)

- Toys (- 42.94 %)

- Bakeries & pastries (- 34.28 %)

- Books & stationery & supplies (- 29.65 %)

- Perfumes and cosmetics (- 28.65 %)

- Tobacco (-26.13 %)

- Watches and jewelry (- 24.45 %)

- Clothing (- 21.16 %)

- Commercial shopping centers (- 19.97 %)

à Optical instruments (- 7.04 %)

à Supermarkets and food shops (- 5.69 %)

- Pharmaceuticals (- 1.21 %)

- Furniture (+ 2.65 %)

- Household electrical equipment (+ 5.64 %)

- Medical Equipment and Appliances (+ 16.85 %)

- Liquors (+ 29.17 %)

As a result, and with our base index 100 fixed at the fourth quarter of 2019, and with a quarterly inflation rate of + 20.25 % for the fourth quarter of 2023, as per the official CAS report, we hereby announce that the new “BTA-Fransabank Retail Index” is (with all sectors included): 56.09 for the fourth quarter of the year 2023. This figure compares to the level of 88.08 registered for the third quarter of 2023.

In conclusion, the “BTA-Fransabank Retail Index” for the fourth quarter of 2023 signals a clear deterioration from its previous level in markets’ activity during the summer season, obviously clearly affected by the ongoing regional events and their immediate commercial and economic effects on Lebanon.

Introduction

The “BTA-Fransabank Retail Index” is the pioneer of indices that the private sector has started to produce (as it was launched in late 2011) with the main objective of addressing the long lasting non availability of regular cyclical data and information relative to the activity of specific sectors of the Lebanese economy.

The main objective of the “BTA-Fransabank Retail Index” is to provide the trading community with a scientific tool that reflects the trend that is witnessed at the level of retail trade on a quarterly basis, bearing in mind that that this index is calculated based on actual data collected from a representative sample of companies distributed into all retail goods and services trading sectors (45 sectors as per the Central Administration of Statistics nomenclature).

This index should be considered as a good reference, bearing in mind that:

- Companies were asked to provide their turnover on a yearly basis by brackets (in millions of USD). They also are asked to provide the quarterly percent change of their turnover for the quarter under review, compared to the same quarter of the previous year, and to the previous quarter of the same year.

Percent change of turnover of current quarter compared to same quarter last year (Q1 - 2011) =

turnover of the current quarter-turnover of same quarter last year / turnover of same quarter last year

Percent change of turnover of current quarter compared to previous quarter of the same year =

turnover of the current quarter-turnover of previous quarter / turnover of previous quarter

* It is important to note that since its launch, the Base 100 for this Index was set at the last quarter of 2011, and quarterly variations were monitored from that base accordingly. Nonetheless, and given the major transformations experienced by the Lebanese economy – especially since the fourth quarter of 2019, it has been decided to monitor the changes in turnover figures of retail trade sectors starting this new milestone date (i.e. the fourth quarter of 2019) for the calculation of this index, while preserving the same methodology and calculation techniques.

Index Methodology

For each sampled establishment the percent change of the turnover is first assigned a weight based on its relative turnover compared to the turnover of the other establishments within the same activity sector (ISIC1 6 digits).

An aggregation is then done within each activity sector (ISIC 6 digits) to calculate a percent change of turnover for this specific activity sector.

We then obtain as many indices as the number of activity sectors (ISIC 6 digits) taken into account.

On a second stage, ISIC level indices are then aggregated using weights based on the cumulated VAT turnover for each activity sector as provided by the Ministry of Finance.

This aggregation provided the final “Beirut Traders Association – Fransabank Retail index” of the commercial activity for the quarter under review.

1ISIC- International Standard Industrial Classification